People have been trying to come up with tips, tricks, formulas, and algorithms for trading for as long as markets have existed. The development of new market sectors, the rise of online trading, and the overall increase in data have led to trillions of dollars exchanging hands between automated systems. Most of this is done by investment firms with incredibly complicated, highly tuned models, and fancy techniques such as high frequency trading and statistical arbitrage. As someone with a moderate amount of data analysis and ML experience (and an unreasonable amount of self-confidence) I want to see how hard it could be, so I decided to try make my own trading algorithm.

All of the code and data is available on Github at: https://github.com/CharlesCardot/LongShortStrategyOptimization/.

Disclaimer: None of this is financial advice. We will also make a few approximations that help simplify the market conditions but lead to a simulation that is not very faithful to reality. See the caveats section at the end.

Cambrian Era Trading

Stection 1: Data Collection

The first step in any sort of data analysis is of course getting the data. However, there is a lot of stock data out there, more than I can fit on a single hard drive. To make it easy, I’m going to focus on the S&P 500, which is an electronically traded fund (ETF) of 500 of the best performing publicly trading companies in the United States. This is a commonly traded, high volume ETF so it’s a good place to start. In particular we are going to want minute by minute data, as fine grained as we can get.

The Alpha Vantage website is a good choice (https://www.alphavantage.co/) for getting data because it’s free and has a simple API. The downside is that it has a maximum of 6 requests per minute, 100 requests per day, and will only send 1 month of data at a time, so we must play some games to patch together all the data we want. We’ll also request extended hours data just so that we can get values for the price at 16:00:00 (5:00 PM) EST.

(If you’d like to follow along, you may need to make a couple different API keys and change your IP address, or you can just skip this part and use the data I’ve already collected)

import re

import os

import json

import copy

import random

import requests

import numpy as np

import pandas as pd

import seaborn as sns

import matplotlib.pyplot as plt

import matplotlib.patches as mpatches

plt.rcParams['xtick.labelsize'] = 15

plt.rcParams['ytick.labelsize'] = 15

plt.rcParams['axes.labelsize'] = 15

plt.rcParams['axes.titlesize'] = 20

plt.rcParams['axes.grid'] = True

plt.rcParams['legend.fancybox'] = True

plt.rcParams['font.family'] = 'serif'

plt.rcParams['font.serif'] = 'Times New Roman'

plt.rcParams['mathtext.fontset'] = 'custom'

plt.rcParams['mathtext.rm'] = 'Times New Roman'

from IPython import display

pd.options.mode.chained_assignment = None # default='warn'

with open('secrets.json', 'r') as secrets_file:

secrets = json.load(secrets_file)

# Define the API endpoint and parameters

endpoint = 'https://www.alphavantage.co/query'

params = {

'function': 'TIME_SERIES_INTRADAY',

'symbol': 'SPY',

'interval': '1min',

'apikey': secrets["alphavantage_apikey"],

'extended_hours': 'true',

'outputsize': 'full',

'month': '2023-07'

}

# Initialize an empty DataFrame to store the data

full_df = pd.DataFrame()

# Define the date range for data retrieval

start_date = datetime(2016, 7, 1)

end_date = datetime(2023, 7, 31)

counter = 0

# Loop through each month within the date range

current_date = start_date

while current_date <= end_date:

month = current_date.strftime('%Y-%m')

params['month'] = month

print("Requesting data for", month)

# Make the API request

response = requests.get(endpoint, params=params)

data = response.json()

# Extract the time series data from the response

time_series = data.get('Time Series (1min)')

if time_series:

counter = 0

# Convert the data to a pandas DataFrame

df = pd.DataFrame.from_dict(time_series, orient='index')

df.index = pd.to_datetime(df.index)

df.columns = ['open', 'high', 'low', 'close', 'volume']

# Filter data between market hours (9:30 AM to 4:00 PM)

df = df.between_time('09:30:00', '16:00:00')

# Append the current month's data to the full DataFrame

full_df = pd.concat([full_df, df])

# Move to the next month

current_date = current_date.replace(day=1) + pd.DateOffset(months=1)

else:

counter += 1

print("API request failed, waiting and retrying")

time.sleep(40) # Maximum API requests per min have been reached

if counter >= 3:

print("Used maximum number of API requests for today")

break

# Sort the full DataFrame by index (date)

full_df.sort_index(inplace=True)

# Save the full DataFrame to a CSV file

full_df.to_csv('full_data_07-2016_to_06-2023.csv')

Section 2: Data Processing, Transformation, and Exploration

Through perfectly ethical means I’ve managed to get two .csv files that together have minute by minute data for every trading day from August 2010 to August 2023. Now I can shove them together into a single, giant pandas dataframe. Fun fact, did you know that Excel has a limit of roughly 1 million rows and 20K columns? It seems like more than enough and it usually is … until it’s not.

market_df_2010to2016 = pd.read_csv("full_data_07-2010_to_06-2016.csv", index_col=0, parse_dates=True)

market_df_2016to2023 = pd.read_csv("full_data_07-2016_to_07-2023.csv", index_col=0, parse_dates=True)

market_df = pd.concat([market_df_2010to2016, market_df_2016to2023])

display.display((market_df.head()))

| index | open | high | low | close | volume |

|---|---|---|---|---|---|

| 2010-07-01 09:30:00 | 80.639 | 80.754 | 80.393 | 80.502 | 1661899 |

| 2010-07-01 09:31:00 | 80.585 | 80.668 | 80.362 | 80.485 | 797772 |

| 2010-07-01 09:32:00 | 80.569 | 80.653 | 80.308 | 80.454 | 1114100 |

| 2010-07-01 09:33:00 | 80.538 | 80.739 | 80.370 | 80.571 | 1464468 |

| 2010-07-01 09:34:00 | 80.655 | 80.754 | 80.425 | 80.524 | 1032889 |

Each minute row has an open, high, low, close, and volume column. This is a way of representing how the price moves within a particular time frame (1 minute chunks in this case). The open (close) is the price at the beginning (end) of the minute, the high (low) is the highest (lowest) price reached within that minute, and the volume is the number of individual units traded during that minute. We can see that the volume is indeed high, with 1 million or so units traded per minute, and roughly 400 million dollars of value traded within the first 5 minutes of the day.

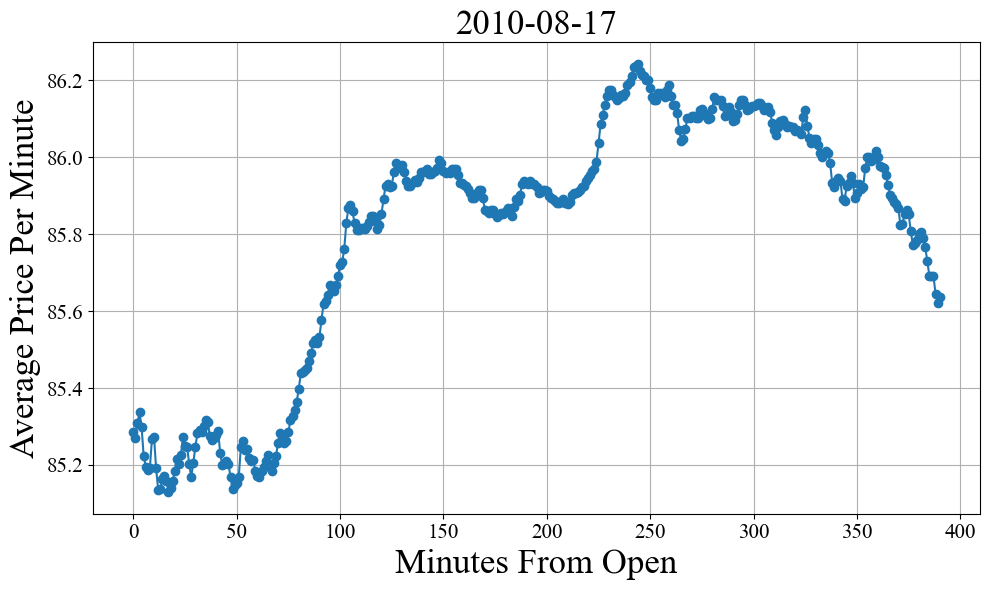

These values are good for getting a detailed picture, but if we want to visualize the value of the stock in a particular day we need to do some sort of averaging to get a single value for the minute. Yes, I know about candle charts, but that’s more complicated than is necessary right now. A reasonable choice is to take the average the open and close values. We will also break off days into individual dataframes to make the entire data set easier to manage.

(Note this may take 5 to 10 minutes to run, or you can just load the pickle object using the next cell)

# Calculate the average of open and close for each minute,

# round to 3 decimals to be consistent with the other price values

market_df["average"] = round((market_df["open"] + market_df["close"]) / 2, 3)

# Get a list of unique dates in the DataFrame

trading_days = []

for date in market_df.index.date:

if date not in trading_days:

trading_days.append(date)

# Sort dataframe into trading days

market_by_days = [market_df[market_df.index.date == date] for date in trading_days]

import pickle

with open('market_by_days.pkl', 'rb') as f:

market_by_days = pickle.load(f)

day = market_by_days[32]

minutes_from_open = ((day.index - day.index[0]).total_seconds().astype(int) // 60).tolist()

plt.figure(figsize=(10, 6))

plt.plot(minutes_from_open, day['average'], marker='o', linestyle='-')

plt.xlabel('Minutes From Open', fontsize=25)

plt.ylabel('Average Price Per Minute', fontsize=25)

plt.title(str(day.index[0].date()), fontsize=25)

plt.tight_layout()

plt.show()

We have liftoff! Note that because the market opens at 9:30:00 AM EST and closes at 16:00:00 PM EST, this corresponds to 6 and a half hours or 390 total minutes of trading time per day. Now it’s time to start looking for trends that can be exploited. One of the simplest things we can try to ask is if certain times of day more correlated with a particular increase or decrease? Do people tend to sell a lot more right at the end of the day so that they can avoid any big overnight market moves? Is there a jump in action around 10:00 AM to 11:00 AM when the west coast wakes up?

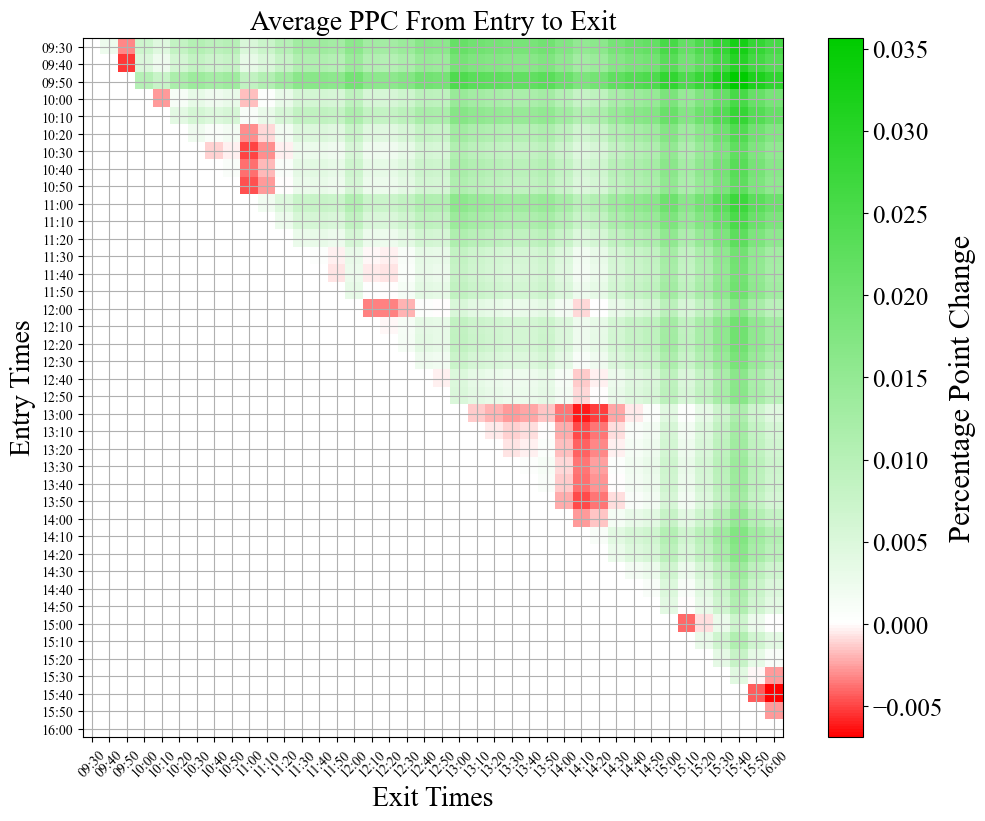

To test this, the code block below loops over every day in our market_by_days list (in 10 minute chunks) and looks at the percentage point change (PPC) from some start time to some stop time. PPC is defined as (end price - start price) / (start price), so if the ETF starts the day at $100 and ends the day at $110 dollars, that’s a PPC of 10%.

import datetime

def x_min_trend(df, x_min_start, x_min_stop):

""" returns the percentage point change from x_min_start to x_min_stop """

temp = df.between_time(x_min_start, x_min_stop, inclusive="both")["average"].values.tolist()

return (temp[-1] - temp[0]) / temp[0] * 100 # percent point change

start_time = datetime.time(9, 30, 0)

end_time = datetime.time(16, 0, 0)

time_interval = datetime.timedelta(minutes=10)

times = [] # List of datetime.time objects, spaced 10 minutes apart

current_datetime = datetime.datetime.combine(datetime.datetime.today(), start_time)

while current_datetime.time() <= end_time:

times.append(current_datetime.time())

current_datetime += time_interval

returns_arr = [] # row is start time, column is end time

for start_time in times:

row = []

for end_time in times:

if start_time < end_time:

returns_temp = []

for df in market_by_days:

try:

returns_temp.append(x_min_trend(df, x_min_start=start_time, x_min_stop=end_time))

except:

pass # For some reason, no data for this minute

row.append(round(np.asarray(returns_temp).mean(), 5))

else:

row.append(np.NaN)

returns_arr.append(row)

from matplotlib.colors import LinearSegmentedColormap

# Colors for the colormap

colors = [(1.0, 0.0, 0.0), (1.0, 1.0, 1.0), (0.0, 0.8, 0.0)] # Red, White, Green

vmax = np.max(np.asarray(returns_arr)[~np.isnan(np.asarray(returns_arr))])

vmin = np.min(np.asarray(returns_arr)[~np.isnan(np.asarray(returns_arr))])

values = [vmin, 0.0, vmax]

norm = plt.Normalize(min(values), max(values))

# Create the custom colormap

custom_cmap = LinearSegmentedColormap.from_list("custom_cmap", list(zip(norm(values), colors)))

plt.figure(figsize=(10, 8))

plt.imshow(returns_arr, cmap = custom_cmap, interpolation = 'nearest')

plt.title("Average PPC From Entry to Exit", fontsize=20)

cbar = plt.colorbar()

cbar.set_label('Percentage Point Change', fontsize=22)

cbar.ax.tick_params(labelsize=18)

plt.xticks(range(len(times)), [t.strftime('%H:%M') for t in times], rotation=45, fontsize=10)

plt.yticks(range(len(times)), [t.strftime('%H:%M') for t in times], fontsize=10)

plt.tight_layout()

plt.ylabel('Entry Times', fontsize=20)

plt.xlabel('Exit Times', fontsize=20)

plt.show()

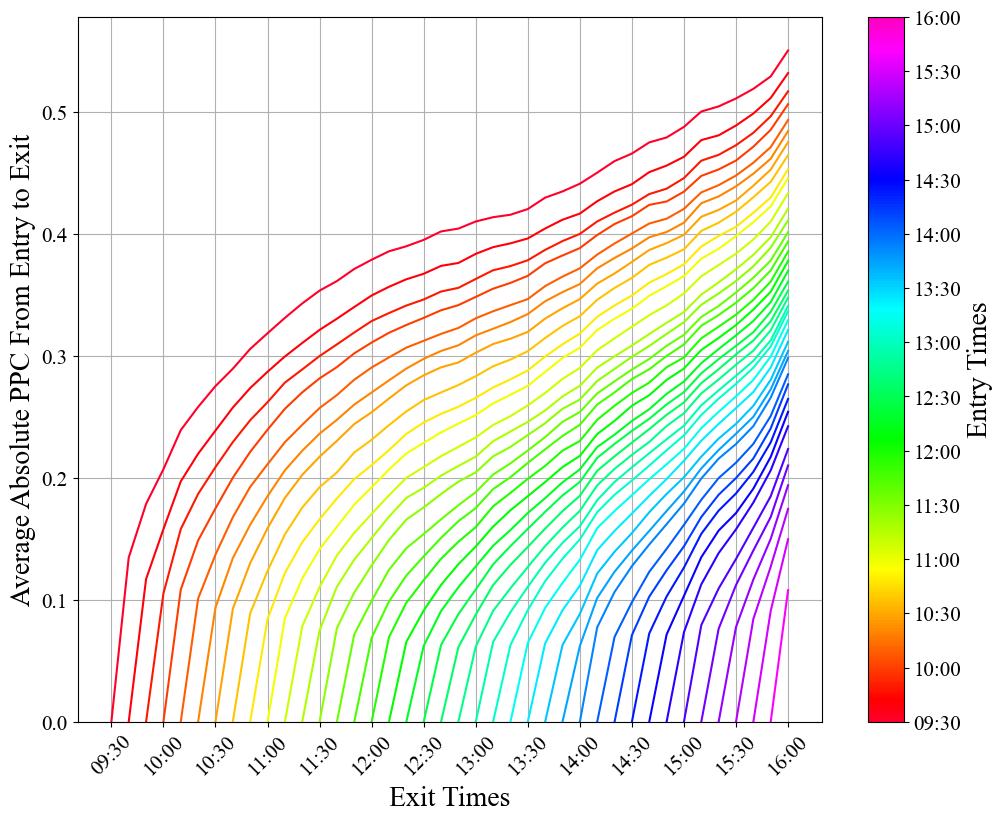

This shows us multiple interesting trends! 1) The average PPC is overwhelmingly positive. This makes a decent amount of sense, as it’s well known that the S&P 500 tends to move upwards over time. 2) On average, the best buy time, sell time combo is buying at the beginning of the day (09:30) and selling just before the end of the day (15:40). Another feather in the cap of the buy and hold strategy. 3) On average the worst buy time, sell time combo is buying right at 15:40 and selling at 16:00. This supports our original hypothesis that there is (on average) a general selloff right before the markets close. This is most likely because overnight the price of a stock or ETF can change dramatically in response to events, making it potentially risky to hold an asset overnight. 4) There is also a pretty large red cloud on the 13:00 to 14:00 time frame, but I don’t have any strong intuition as to why this could be, other than people coming back from lunch. 5) The times that are more significant to us as a society (hour and half hour marks) can be seen identified by the slight checkerboard pattern that their lines make across the plot. This just goes to show how psychology can be a big part of how the market moves.

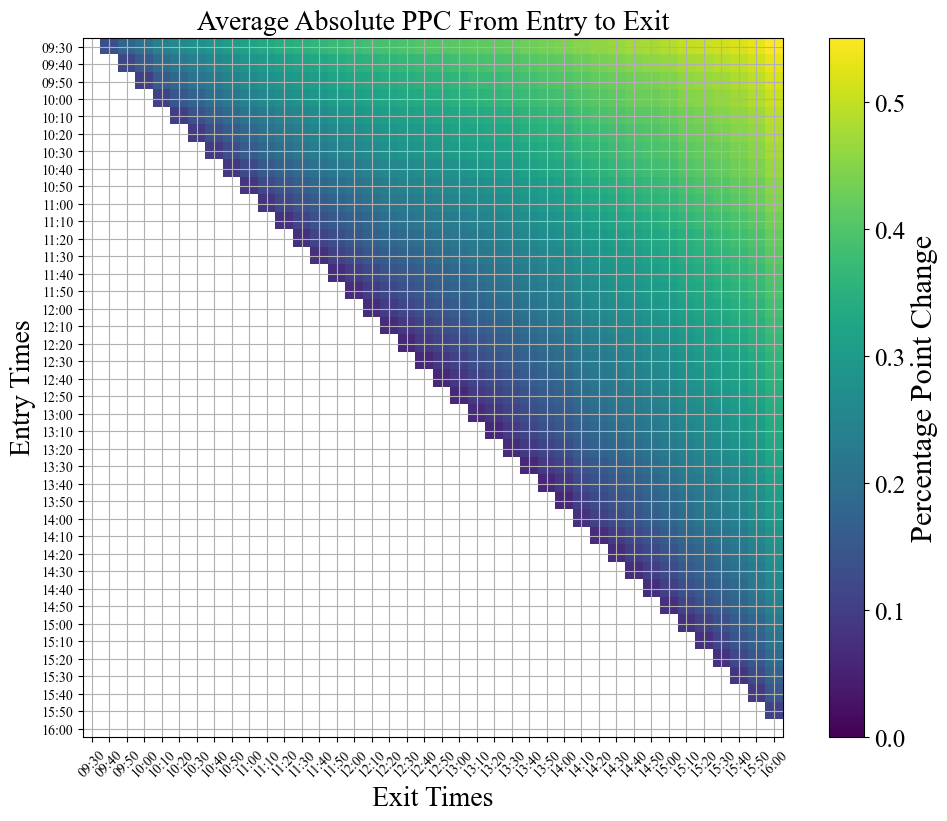

At the end of the day though, these are all pretty small PPCs. The maximum avg value we see is 0.03%, which annualized over a year comes in a just under 10% annual returns (accounting for only 252 trading days per year). It’s possible that this edge could be exploited by a model which uses the statistical behavior to its advantage, but that kind of near future price direction prediction is difficult at best, and the edge is not that strong. I’d much rather go for something with much more upside. Let’s try looking at the average absolute PPC to see where the most dramatic price swings are.

start_time = datetime.time(9, 30, 0)

end_time = datetime.time(16, 0, 0)

time_interval = datetime.timedelta(minutes=10)

times = [] # List of datetime.time objects, spaced 10 minutes apart

current_datetime = datetime.datetime.combine(datetime.datetime.today(), start_time)

while current_datetime.time() <= end_time:

times.append(current_datetime.time())

current_datetime += time_interval

abs_returns_arr = [] # row is start time, column is end time

for start_time in times:

row = []

for end_time in times:

if start_time < end_time:

returns_temp = []

for df in market_by_days:

try:

returns_temp.append(x_min_trend(df, x_min_start=start_time, x_min_stop=end_time))

except:

pass # For some reason, no data for this minute

absolute_ppc = round(np.abs(np.asarray(returns_temp)).mean(), 5)

row.append(absolute_ppc)

else:

row.append(np.NaN)

abs_returns_arr.append(row)

plt.figure(figsize=(10, 8))

plt.imshow(abs_returns_arr, cmap='viridis', interpolation = 'nearest', vmin=0)

plt.title("Average Absolute PPC From Entry to Exit", fontsize=20)

cbar = plt.colorbar()

cbar.set_label('Percentage Point Change', fontsize=22)

cbar.ax.tick_params(labelsize=18)

plt.xticks(range(len(times)), [t.strftime('%H:%M') for t in times], rotation=45, fontsize=10)

plt.yticks(range(len(times)), [t.strftime('%H:%M') for t in times], fontsize=10)

plt.tight_layout()

plt.ylabel('Entry Times', fontsize=20)

plt.xlabel('Exit Times', fontsize=20)

plt.show()

plt.figure(figsize=(10, 8))

cmap = plt.get_cmap('gist_rainbow')

x = np.arange(0,len(times),1)

for i, row in enumerate(abs_returns_arr):

last_nan_index = row[::-1].index(np.nan)

last_nan_index = len(row) - last_nan_index - 1

row[last_nan_index] = 0

color = cmap(i / len(abs_returns_arr))

plt.plot(x, row, color=color)

plt.xticks(np.arange(0, len(times), 3), [t.strftime('%H:%M') for i, t in enumerate(times) if i % 3 == 0], rotation=45)

sm = plt.cm.ScalarMappable(cmap=cmap, norm=plt.Normalize(vmin=0, vmax=len(abs_returns_arr) - 1))

sm.set_array([])

cbar = plt.colorbar(sm, ax=plt.gca(), ticks=np.arange(0, len(times), 3))

cbar.set_label('Entry Times', fontsize=20)

cbar.set_ticklabels([t.strftime('%H:%M') for i, t in enumerate(times) if i % 3 == 0])

plt.ylim(0, None)

plt.tight_layout()

plt.ylabel('Average Absolute PPC From Entry to Exit', fontsize=20)

plt.xlabel('Exit Times', fontsize=20)

plt.show()

start_time = datetime.time(9, 30, 0)

end_time = datetime.time(16, 0, 0)

time_interval = datetime.timedelta(minutes=30)

times = [] # List of datetime.time objects, spaced 30 minutes apart

current_datetime = datetime.datetime.combine(datetime.datetime.today(), start_time)

while current_datetime.time() <= end_time:

times.append(current_datetime.time())

current_datetime += time_interval

abs_returns_arr = [] # row is start time, column is end time

for start_time in times:

row = []

for end_time in times:

if start_time < end_time:

returns_temp = []

for df in market_by_days:

try:

returns_temp.append(x_min_trend(df, x_min_start=start_time, x_min_stop=end_time))

except:

pass # For some reason, no data for this minute

absolute_ppc = round(np.abs(np.asarray(returns_temp)).mean(), 5)

row.append(absolute_ppc)

else:

row.append(np.NaN)

abs_returns_arr.append(row)

y_30 = []

times_30 = [t.strftime('%H:%M') + " to " + times[i+1].strftime('%H:%M') for i, t in enumerate(times) if i != len(times) - 1]

y_60 = []

times_60 = [t.strftime('%H:%M') for i, t in enumerate(times) if i % 2 == 0]

times_60 = [t + " to " + times_60[i+1] for i, t in enumerate(times_60) if i != len(times_60) - 1]

for key, row in enumerate(abs_returns_arr):

row = np.asarray(row)

row = row[~np.isnan(row)]

try:

y_30.append(row[0])

except:

pass

try:

if key % 2 == 0:

y_60.append(row[1])

except:

pass

# Create a figure with two subplots in the same row

fig, axes = plt.subplots(1, 2, figsize=(16, 8))

axes[0].set_title('30 minute chunks', fontsize = 25)

axes[0].set_xlabel('Time', fontsize = 25)

axes[0].set_ylabel('Percentage Point Change', fontsize = 25)

axes[0].xaxis.grid(False)

axes[0].yaxis.grid(True, color='gray', zorder=0)

axes[0].bar(times_30, y_30, color=sns.color_palette()[9], zorder=2)

axes[0].set_xticklabels(times_30, rotation=60)

plt.xticks(rotation=45)

axes[1].set_title('60 minute chunks', fontsize = 25)

axes[1].set_xlabel('Time', fontsize = 25)

axes[1].set_ylabel('Percentage Point Change', fontsize = 25)

axes[1].xaxis.grid(False)

axes[1].yaxis.grid(True, color='gray', zorder=0)

axes[1].bar(times_60, y_60, color=sns.color_palette()[1], zorder=2)

axes[1].set_xticklabels(times_60, rotation=60)

plt.tight_layout()

plt.show()

Section 3: Algorithm Design

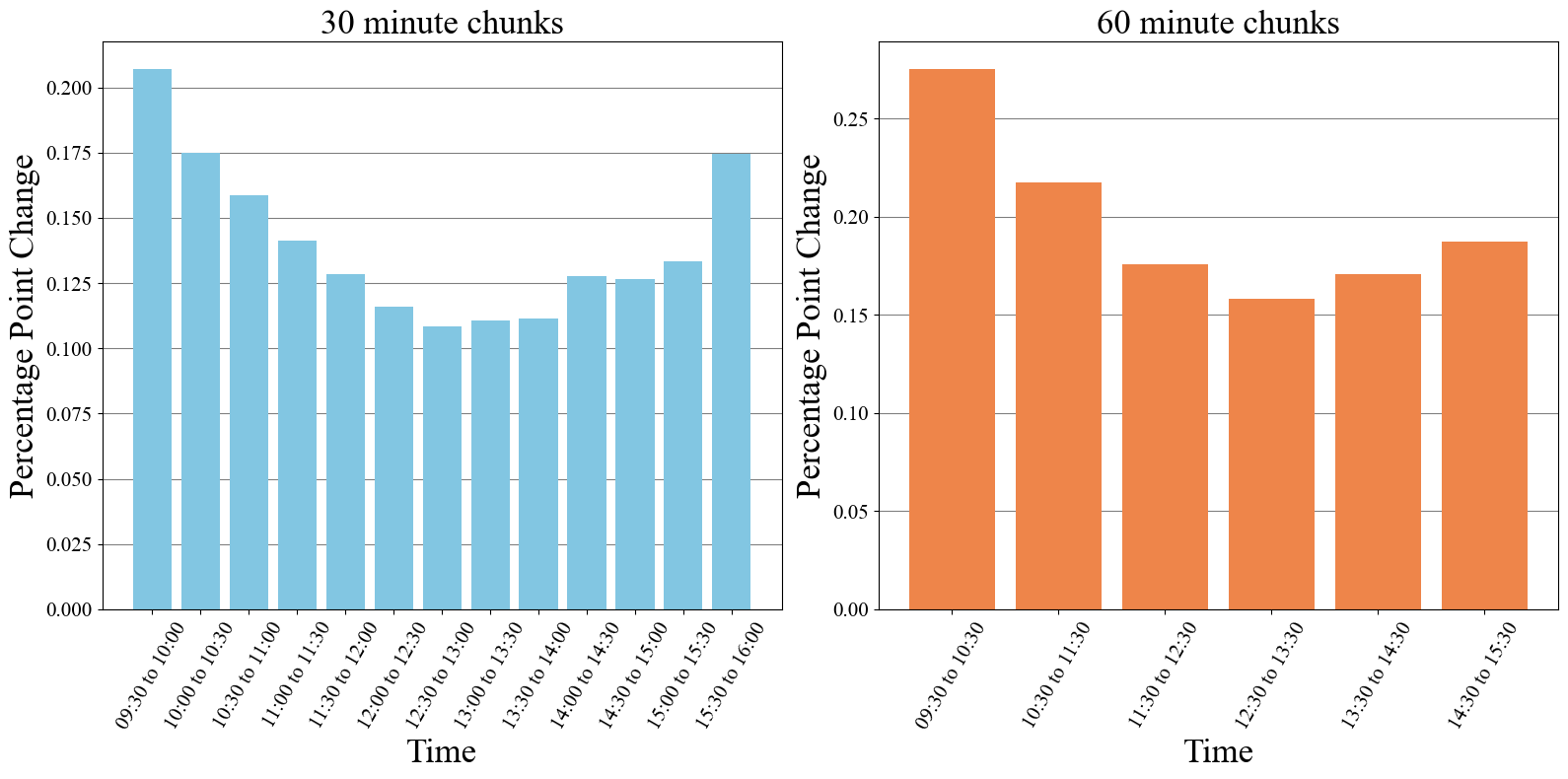

Our data mining has shown us that the largest percentage point changes are of coming from the times around the open and the close of each day. This makes sense as these are also the most volatile (large number of units being traded). This gives us something to focus on. If we can come up with a strategy that capture the volatility of the opening 30 to 60 minutes, then there is decent potential profits.

We need a way of making a net gain both when the value increases or decreases, which sounds pretty impossible on the surface, but can be accomplished by with some slightly more sophisticated financial instruments and a careful attention to timing.

Let’s establish some terminology that will make it easier to explain how this idea works.

- Position: The ownership of a particular stock, security, or other financial instrument

- Long Position: This is a position in which if the value of the underlying asset goes up, then the value of this position also goes up accordingly. This can be as simple as buying and holding a stock.

- Short Position: The inverse of a long position (long versus short). If the value of the underlying asset goes up, the value of the position goes down accordingly. See https://en.wikipedia.org/wiki/Short_(finance) for more information.

- Stop Loss: This is a price point at which, if the price of the underlying asset is at or below this price, the asset gets sold. If you have a long position and the price of your asset is dropping you want to avoid loosing money. So by setting a stop loss order, you are essentially stopping any additional losses by exiting that position.

- Take Profit: This is a price at which, if the price of the underlying asset is at or above this price, the asset gets sold. Same concept as the stop loss, except now that the asset has hopefully increased in value up to the price of your take profit, you want to sell it an take your profits.

So, if we were to enter both a long and a short position at the same time, it doesn’t matter how the value of the underlying asset changes because the two positions will cancel each other out. However, if high volatility causes the asset to jump quickly up or down, we can try to come up with a way of selling the loosing position early (with a stop loss) and hold onto the winning position until it hits a take profit level, exiting with a net profit that is the difference between the take profit and stop loss levels. As long as the directional movement is high enough, and we can time our orders properly, this approach can be profitable. Note: This is the same concept behind a reverse iron condor, but if you already know what that is, then you probably aren’t getting much out of my little tutorial to begin with.

Visualizing how these rules play out is much easier with a little simulation, see below.

In the above simulation we have taken a particular day from our dataset, opened a long and short position, and set an x_percent_loss and y_percent_gain value. The x_percent_loss is the percentage loss that either the long or short position must hit before being sold. The times at which the account value is flat is when either both the long and short positions are being held simultaneously, or both positions have been exited. In this example, the price of the S&P 500 increases from the opening value and hits the short stop-loss first. The short position gets sold, and the long position is held until it reaches the y_percent_gain value, leading to a nice net 1.2% profit for the day.

This is of course a cherry picked example, but it shows the potential of this idea.

The main downside of this approach is that that any sideways moving days, where there isn’t a large price movement up or down, runs the risk of hitting both the long and short stop loss, resulting in a net loss for the day. We need it to hit a take profit value so that the algorithm can sell before any reversals. However, we don’t want to set the take profit value too low, otherwise we might miss out on the upside of any high volatility days. There are some methods we can use to address this, and it’s best to lay out our proposed algorithm as a series of steps/rules.

Long-Short Strategy

- Open a long and short position simultaneously at the start of trading day.

- If either position loses x percent, sell the position.

- If the winning position reaches some threshold, move the remaining stop loss value to a breakeven position.

- If the winning position gains y percent, implement a trailing stop loss.

- At the end of day close any remaining positions.

Rule 3 helps cut down on the risk of a losing day by moving the stop loss of the winning position to be a price where, if it is hit, then the profit from the winning position cancels out the loss from the loosing position. Rule 4 allows us to have some trailing stop loss that will prevent us from taking profit too early on big swing days. Finally rule 5 just prevents us from holding any positions overnight, allowing us to avoid any big market moves that might jump over our stop loss values and lead to more losses than we’re comfortable taking.

Let’s see what this looks like simulated.

from matplotlib.animation import FuncAnimation

def animate_simulation(market_day,

x_percent_loss = -0.4 / 100,

y_percent_gain = 1.6 / 100,

be_threshold = 0.8 / 100,

tslp = 0.4 / 100,

frames = 390,

interval = 50):

"""

Visual animation of the algorithm being executed.

Parameters

----------

market_day: This index selects a specific day from the market_by_days list

x_percent_loss: The ppc that either position is alowed to lose, after which point it gets sold.

This sets the starting stop loss values.

y_percent_gain: Equivalent to take profit, once this ppc is reached a trailing stop less gets implemented

be_threshold: The ppc which once reached will trigger the stop loss on the winning position to

be moved to a break even position

tslp: The trailing stop loss percentage, this is measured from the high peak or lowest trough of the day,

depending on if the remaining position is long or short.

frames: Integer umber of frames to animate (each frame is equivalent to 1 minute)

interval: Integer delay between frames in milliseconds

"""

df = market_by_days[market_day]

open_price = df.iloc[0]['average'] # Open position at the first minute's average price

betting_value = 2000 / 2

long_position = {'open_value': betting_value, 'current_value': betting_value}

short_position = {'open_value': betting_value, 'current_value': betting_value}

value_of_investment = [2000]

sl_value = betting_value * (1 + x_percent_loss) # stop-loss value

tp_value = betting_value * (1 + y_percent_gain) # take-profit value

be_value = betting_value * (1 + be_threshold) # breakeven threshold

final_bet_value = 0

trailing_sl_triggered = False

be_value_triggered = False

prices = df["average"].tolist()

sl_positions = [[],[]] # keys/indexs list, tslp values list

be_trigger = None # Key value for breakeven trigger being reached

for key, current_price in enumerate(prices):

if key == 0:

continue

temp_value_of_investment = final_bet_value

if long_position:

long_position['current_value'] = (1 + (current_price - open_price) / open_price) * long_position['open_value']

temp_value_of_investment += long_position['current_value']

if short_position:

short_position['current_value'] = (1 + -1 * (current_price - open_price) / open_price) * short_position['open_value']

temp_value_of_investment += short_position['current_value']

value_of_investment.append(temp_value_of_investment)

# Check for stop loss condition reached on long position

if long_position and long_position['current_value'] <= sl_value:

final_bet_value += sl_value

value_of_investment[-1] += sl_value - long_position['current_value']

long_position = None

if short_position:

first_position_exit = key

else:

second_position_exit = key

# Check for stop loss condition reached on short position

elif short_position and short_position['current_value'] <= sl_value:

final_bet_value += sl_value

value_of_investment[-1] += sl_value - short_position['current_value']

short_position = None

if long_position:

first_position_exit = key

else:

second_position_exit = key

# Trailing stop loss management

if not trailing_sl_triggered:

# Check for trailing stop condition reached on long position

if long_position and long_position['current_value'] >= tp_value:

sl_value = long_position['current_value'] * (1 - tslp)

trailing_sl_triggered = True

sl_positions[0].append(key)

sl_positions[1].append(current_price * (1 - tslp))

# Check for trailing stop condition reached on short position

elif short_position and short_position['current_value'] >= tp_value:

sl_value = short_position['current_value'] * (1 - tslp)

trailing_sl_triggered = True

sl_positions[0].append(key)

sl_positions[1].append(current_price * (1 + tslp))

else:

if long_position and sl_value < long_position['current_value'] * (1 - tslp):

sl_value = long_position['current_value'] * (1 - tslp)

sl_positions[0].append(key)

sl_positions[1].append(current_price * (1 - tslp))

elif short_position and sl_value < short_position['current_value'] * (1 - tslp):

sl_value = short_position['current_value'] * (1 - tslp)

sl_positions[0].append(key)

sl_positions[1].append(current_price * (1 + tslp))

# Condition for moving sl_value to breakeven after one of the positions has stopped out

if be_value_triggered == False:

if long_position is not None and short_position is None and long_position['current_value'] >= be_value:

sl_value = betting_value * (1 + -1 * x_percent_loss)

be_trigger = key

be_value_triggered = True

if short_position is not None and long_position is None and short_position['current_value'] >= be_value:

sl_value = betting_value * (1 + -1 * x_percent_loss)

be_trigger = key

be_value_triggered = True

if long_position or short_position:

second_position_exit = key

x = np.arange(len(df))

fig, axs = plt.subplots(2, 1, figsize=(6, 9), sharex=True)

top_plot = axs[0].plot([])[0]

axs[0].set_ylabel("Net Position Value", fontsize=25)

bot_plot = axs[1].plot([])[0]

axs[1].set_xlabel("Minutes from Open", fontsize=25)

axs[1].set_ylabel("S&P 500 Price", fontsize=25)

# Limiting range of plots

x_min, x_max = -10, 410

axs[0].set_xlim(x_min, x_max)

axs[1].set_xlim(x_min, x_max)

y_range = max(value_of_investment) - min(value_of_investment)

axs[0].set_ylim(min(value_of_investment) - 0.1 * y_range, max(value_of_investment) + 0.1 * y_range)

y_range = max(prices) - min(prices)

lowest_rel_value = min(min(prices), prices[0] * (1 - y_percent_gain))

highest_rel_value = max(max(prices), prices[0] * (1 + y_percent_gain))

y_min = lowest_rel_value - 0.2 * y_range

y_max = highest_rel_value + 0.2 * y_range

axs[1].set_ylim(y_min, y_max)

fig.suptitle('Single Day Simulation', fontsize=25, x=0.60, y=0.98)

# Start making line labels

x_range = x_max - x_min

y_range = y_max - y_min

text_x_pos = x_max - 0.025 * x_range

height_above_line = y_range * 0.04

line_labels = {}

line_labels['initial_short_stop'] = axs[1].text(text_x_pos,

prices[0] * (1 - x_percent_loss) + height_above_line,

'Short Stop-Loss', fontsize=12, color='gray', verticalalignment='center', horizontalalignment='right')

line_labels['initial_long_stop'] = axs[1].text(text_x_pos,

prices[0] * (1 + x_percent_loss) + height_above_line,

'Long Stop-Loss', fontsize=12, color='gray', verticalalignment='center', horizontalalignment='right')

# Make initial stop loss horizontal lines

initial_short_stop = axs[1].axhline(y=prices[0] * (1 - x_percent_loss), color='tab:orange', linestyle='--')

initial_long_stop = axs[1].axhline(y=prices[0] * (1 + x_percent_loss), color='tab:orange', linestyle='--')

# Setup be_threshold line

if prices[first_position_exit] < prices[0]:

be_threshold_line = axs[1].axhline(y=prices[0] * (1 - be_threshold), color='tab:purple', linestyle='--')

line_labels['be_threshold'] = axs[1].text(text_x_pos,

prices[0] * (1 - be_threshold) + height_above_line,

'Break Even Threshold', fontsize=12, color='gray', verticalalignment='center', horizontalalignment='right')

else:

be_threshold_line = axs[1].axhline(y=prices[0] * (1 + be_threshold), color='tab:purple', linestyle='--')

line_labels['be_threshold'] = axs[1].text(text_x_pos,

prices[0] * (1 + be_threshold) + height_above_line,

'Break Even Threshold', fontsize=12, color='gray', verticalalignment='center', horizontalalignment='right')

be_threshold_line.set_visible(False)

line_labels['be_threshold'].set_visible(False)

# Setup take profit line

if prices[first_position_exit] < prices[0]:

tp_line = axs[1].axhline(y=prices[0] * (1 - y_percent_gain), color='green', linestyle='--')

line_labels['tp'] = axs[1].text(text_x_pos,

prices[0] * (1 - y_percent_gain) + height_above_line,

'Short Take-Profit', fontsize=12, color='gray', verticalalignment='center', horizontalalignment='right')

else:

tp_line = axs[1].axhline(y=prices[0] * (1 + y_percent_gain), color='green', linestyle='--')

line_labels['tp'] = axs[1].text(text_x_pos,

prices[0] * (1 + y_percent_gain) + height_above_line,

'Long Take-Profit', fontsize=12, color='gray', verticalalignment='center', horizontalalignment='right')

tp_line.set_visible(False)

line_labels['tp'].set_visible(False)

plt.tight_layout()

plt.subplots_adjust(hspace=0)

def AnimationFunction(frame):

top_plot.set_data((x[0:frame], value_of_investment[0:frame]))

bot_plot.set_data((x[0:frame], prices[0:frame]))

# Position exits

if frame == first_position_exit+1:

axs[1].axvline(x = first_position_exit, color = 'gray', dashes=[2,2])

if prices[first_position_exit] < prices[0]:

initial_long_stop.set_visible(False)

line_labels['initial_long_stop'].set_visible(False)

else:

initial_short_stop.set_visible(False)

line_labels['initial_short_stop'].set_visible(False)

be_threshold_line.set_visible(True)

line_labels['be_threshold'].set_visible(True)

# Managing be_threshold

if be_trigger and frame == be_trigger+1:

if prices[first_position_exit] < prices[0]:

initial_short_stop.set_ydata((prices[0] * (1 + x_percent_loss)))

line_labels['initial_short_stop'].set_position((text_x_pos, prices[0] * (1 + x_percent_loss) + height_above_line))

else:

initial_long_stop.set_ydata((prices[0] * (1 - x_percent_loss)))

line_labels['initial_long_stop'].set_position((text_x_pos, prices[0] * (1 - x_percent_loss) + height_above_line))

be_threshold_line.set_visible(False)

line_labels['be_threshold'].set_visible(False)

tp_line.set_visible(True)

line_labels['tp'].set_visible(True)

# Trailing Stop Losses

if sl_positions and frame in sl_positions[0]:

tp_line.set_visible(False)

line_labels['tp'].set_visible(False)

if prices[first_position_exit] < prices[0]:

initial_short_stop.set_ydata((sl_positions[1][sl_positions[0].index(frame)]))

line_labels['initial_short_stop'].set_position((text_x_pos, sl_positions[1][sl_positions[0].index(frame)] + height_above_line))

else:

initial_long_stop.set_ydata((sl_positions[1][sl_positions[0].index(frame)]))

line_labels['initial_long_stop'].set_position((text_x_pos, sl_positions[1][sl_positions[0].index(frame)] + height_above_line))

# 2nd position exit line

if frame == second_position_exit+1:

axs[1].axvline(x = second_position_exit, color = 'gray', dashes=[2,2])

anim_created = FuncAnimation(fig, AnimationFunction, frames=frames, interval=interval)

video = anim_created.to_html5_video()

html = display.HTML(video)

display.display(html)

plt.close()

animate_simulation(market_day = 4)

animate_simulation(market_day = 32,

x_percent_loss = -0.2 / 100,

y_percent_gain = 0.8 / 100,

be_threshold = 0.4 / 100,

tslp = 0.3 / 100,

frames = 390,

interval = 75)

In the first of the two simulated examples (market day 4), the breakeven threshold variable works to ensure that there is no net loss. This day did not have much price volatility, but we still managed to avoid losing money.

In the second animated example (market day 0), the trailing stop loss works as intended, and allows us to capture slightly more profit than if we had just set the take profit by itself.

Algorithm Metrics: Yearly Return, Maximum Drawdown (%), Longest Drawdown

Great, now that we’ve established our algorithm, let’s see how it performs! An easy way of measuring performance is by average yearly return. The standard yearly return of the S&P 500 is about 10%, so if we can beat this then that’s pretty good. Another metric we should consider is something known as drawdown which refers to how much the value of an asset has dropped from its peak. We will use both max drawdown percentage (the maximum percentage drop from a peak) and longest drawdown (the length in days of the longest period of drawdown) as our metrics. These are both important to consider because they play a big role in the psychological aspect of any investment strategy. If our algorithm returns 50% per year returns (which would be insanely good), but has a maximum drawdown of 90%, then that means at some point during the simulated timeframe we lost nearly everything. This can make it very difficult to stick with an algorithm; that type of volatility can be just as detrimental to our mental game as it is to our account value.

Algorithm Testing Framework

We also need to talk about how we simulate across multiple days. Our metrics depend on day-to-day effects (compound return, continuous days of drawdown, ect) and our algorithm doesn’t depend on day-to-day trends (no positions held overnight). Given that we want to be able to test the effectiveness of this algorithm with real world market behavior, the ideal situation would be to have multiple five to ten year sub sets that we could average the performance over. Averaging is an important step because it will prevent overfitting later. However, minute by minute data didn’t exist before the last 20 or so years. There are some techniques to overcome this issue such as a moving range (ex: 16 unique 5 year chunks in a 20 year stretch) and Monte Carlo methods. It will be sufficient to take random subsets of our entire ~12 years of data. This will allow us to generate a huge training data set, with the drawback that the days in each subset will be entirely uncorrelated. This isn’t an unreasonable approximation, as it’s often stated that markets behave essentially like random noise with non-static correlations. This is still an active area of research though, see https://www.sciencedirect.com/science/article/pii/S0264999318306849 for more information. For our purposes, we use this simplifying approximation and gladly ignore any consequences.

The code below works exactly the same as the simulations we ran early but keeps track of a balance list which represents the account value over the course of multiple days. This is used to calculate the various metrics, as well as a few more useful pieces of information.

debug = False # Make this true to print out all the debug messages

def my_algorithm(random_seed, day_num, starting_balance, x_percent_loss, y_percent_gain, be_threshold, tslp):

"""

Simulates returns using the algorithm described in the markdown above

and returns a list of daily balances along with various statistics about

the returns and drawdowns.

"""

random.seed(random_seed)

balance = [starting_balance]

for df in random.sample(market_by_days, day_num):

open_price = df.iloc[0]['average'] # Open position at the first minute's average price

betting_value = balance[-1] / 2

balance.append(0) # Betting everything, so current balance for the day is zero

long_position = {'open_value': betting_value, 'current_value': betting_value}

short_position = {'open_value': betting_value, 'current_value': betting_value}

sl_value = betting_value * (1 + x_percent_loss) # stop-loss value

tp_value = betting_value * (1 + y_percent_gain) # take-profit value

be_value = betting_value * (1 + be_threshold)

final_bet_value = 0

trailing_sl_triggered = False

be_value_triggered = False

debug_msg_arr = []

prices = df["average"].tolist()

for current_price in prices:

if not long_position and not short_position:

break # break loop once all positions are closed out

if long_position:

debug_msg_arr.append(("long_position", round(long_position['current_value'], 5), round(long_position['current_value'] / long_position['open_value'], 5)))

long_position['current_value'] = (1 + (current_price - open_price) / open_price) * long_position['open_value']

if short_position:

debug_msg_arr.append(("short_position", round(short_position['current_value'], 5), round(short_position['current_value'] / short_position['open_value'], 5)))

short_position['current_value'] = (1 + -1 * (current_price - open_price) / open_price) * short_position['open_value']

# Check for stop loss condition reached on long position

if long_position and long_position['current_value'] <= sl_value:

debug_msg_arr.append(("Stop loss on long_position reached with long value ratio at ", round(long_position['current_value'] / long_position['open_value'], 5)))

final_bet_value += sl_value # Assume perfect order filling, no slippage

long_position = None

# Check for stop loss condition reached on short position

elif short_position and short_position['current_value'] <= sl_value:

debug_msg_arr.append(("Stop loss on short_position reached with short value ratio at ", round(short_position['current_value'] / short_position['open_value'], 5)))

final_bet_value += sl_value # Assume perfect order filling, no slippage

short_position = None

# Trailing stop loss management

if not trailing_sl_triggered:

# Check for trailing stop condition reached on long position

if long_position and long_position['current_value'] >= tp_value:

debug_msg_arr.append(("Trigging trailing stop loss on long at ", round(long_position['current_value'] / long_position['open_value'], 5)))

sl_value = long_position['current_value'] * (1 - tslp)

debug_msg_arr.append(("Setting sl_value to ", round(sl_value, 5), "relative to ", round(long_position['current_value'], 5)))

trailing_sl_triggered = True

# Check for trailing stop condition reached on short position

elif short_position and short_position['current_value'] >= tp_value:

debug_msg_arr.append(("Trigging trailing stop loss on short at ", round(short_position['current_value'] / short_position['open_value'], 5)))

sl_value = short_position['current_value'] * (1 - tslp)

debug_msg_arr.append(("Setting sl_value to ", round(sl_value, 5), "relative to ", round(short_position['current_value'], 5)))

trailing_sl_triggered = True

else:

if long_position and sl_value < long_position['current_value'] * (1 - tslp):

sl_value = long_position['current_value'] * (1 - tslp)

debug_msg_arr.append(("Updating trailing stop loss to", round(sl_value, 5), "with long at", round(long_position['current_value'], 5)))

elif short_position and sl_value < short_position['current_value'] * (1 - tslp):

sl_value = short_position['current_value'] * (1 - tslp)

debug_msg_arr.append(("Updating trailing stop loss to", round(sl_value, 5), "with short at", round(short_position['current_value'], 5)))

# Condition for moving sl_value to breakeven after one of the positions has stopped out

if be_value_triggered == False:

if long_position is not None and short_position is None and long_position['current_value'] >= be_value:

debug_msg_arr.append(("be_value on long_position reached with short at ", round(long_position['current_value'] / long_position['open_value'], 5)))

sl_value = betting_value * (1 + -1 * x_percent_loss)

be_value_triggered = True

if short_position is not None and long_position is None and short_position['current_value'] >= be_value:

debug_msg_arr.append(("be_value on short_position reached with short at ", round(short_position['current_value'] / short_position['open_value'], 5)))

sl_value = betting_value * (1 + -1 * x_percent_loss)

be_value_triggered = True

# Close any remaining positions at the end of the day

if long_position:

debug_msg_arr.append(("Closing long position at ", long_position['current_value']))

final_bet_value += long_position['current_value']

if short_position:

debug_msg_arr.append(("Closing short position at ", short_position['current_value']))

final_bet_value += short_position['current_value']

balance[-1] += final_bet_value

if debug:

for msg in debug_msg_arr:

print(msg)

print()

balance = np.asarray(balance)

# Calculate average daily return

daily_returns = np.diff(balance) / balance[:-1]

average_daily_return = np.mean(daily_returns) * 100

# Calculate drawdowns

peak = balance[0]

drawdowns = [[], [], []] # [[start_day], [stop_day], [drawdown_value]]

in_drawdown = False

current_drawdown_value = 0

max_drawdown_value = 0

for i, b in enumerate(balance):

if b >= peak:

if in_drawdown:

drawdown_end = i-1

drawdowns[0].append(drawdown_start)

drawdowns[1].append(drawdown_end)

drawdowns[2].append(max_drawdown_value)

max_drawdown_value = 0

in_drawdown = False

peak = b

else:

if not in_drawdown:

drawdown_start = i-1

in_drawdown = True

current_drawdown_value = (peak - b) / peak

if max_drawdown_value < current_drawdown_value:

max_drawdown_value = current_drawdown_value

if i == len(balance) - 1:

drawdown_end = i

drawdowns[0].append(drawdown_start)

drawdowns[1].append(drawdown_end)

drawdowns[2].append(max_drawdown_value)

average_drawdown = np.mean(drawdowns[2]) * 100

max_drawdown_byper = np.max(drawdowns[2]) * 100 # Convert max drawdown to percentage

max_drawdown_byper_start = drawdowns[0][np.argmax(drawdowns[2])] # measured by percentage

max_drawdown_byper_end = drawdowns[1][np.argmax(drawdowns[2])] # measured by percentage

duration_of_max_drawdown = max_drawdown_byper_end - max_drawdown_byper_start # Duration in days of the maximum drawdown (by percent)

drawdown_durations = np.asarray([drawdowns[1][i] - drawdowns[0][i] for i in range(len(drawdowns[0]))])

max_drawdown_bydur = drawdowns[2][np.argmax(drawdown_durations)] * 100

max_drawdown_bydur_start = drawdowns[0][np.argmax(drawdown_durations)] # measured by duration

max_drawdown_bydur_end = drawdowns[1][np.argmax(drawdown_durations)] # measured by duration

duration_of_longest_drawdown = max_drawdown_bydur_end - max_drawdown_bydur_start # Duration in days of the longest drawdown

# Calculate average drawdown duration

average_drawdown_duration = np.mean(drawdown_durations)

# Calculate average yearly return

average_yearly_return = ((balance[-1] / balance[0]) ** (252 / len(balance)) - 1) * 100

return {

"Balance" : balance,

"drawdowns": drawdowns,

"Avg Daily Return": average_daily_return,

"Avg Drawdown": average_drawdown,

"Avg Drawdown Duration (Days)": average_drawdown_duration,

"Max Drawdown By Percent": max_drawdown_byper,

"Max Drawdown By Percent Start": max_drawdown_byper_start,

"Max Drawdown By Percent End": max_drawdown_byper_end,

"Duration of Max Drawdown (Days)": duration_of_max_drawdown,

"Max Drawdown By Duration": max_drawdown_bydur,

"Max Drawdown By Duration Start": max_drawdown_bydur_start,

"Max Drawdown By Duration End": max_drawdown_bydur_end,

"Duration of Longest Drawdown (Days)": duration_of_longest_drawdown,

"Avg Yearly Return": average_yearly_return

}

random_seed = 5

day_num = 2000 # Number of days to simulate over

# Assuming the initial balance is $2000

starting_balance = 2000

x_percent_loss = -0.2 / 100 # x percent loss threshold

y_percent_gain = 0.5 / 100 # y percent gain threshold

be_threshold = 0.3 / 100 # breakeven threshold

tslp = 0.2 / 100 # trailing stop loss percentage

report = my_algorithm(random_seed, day_num, starting_balance, x_percent_loss, y_percent_gain, be_threshold, tslp)

balance = report["Balance"]

average_daily_return = report["Avg Daily Return"]

average_drawdown = report["Avg Drawdown"]

average_drawdown_duration = report["Avg Drawdown Duration (Days)"]

max_drawdown_byper = report["Max Drawdown By Percent"]

max_drawdown_byper_start = report["Max Drawdown By Percent Start"]

max_drawdown_byper_end = report["Max Drawdown By Percent End"]

duration_of_max_drawdown = report["Duration of Max Drawdown (Days)"]

max_drawdown_bydur = report["Max Drawdown By Duration"]

max_drawdown_bydur_start = report["Max Drawdown By Duration Start"]

max_drawdown_bydur_end = report["Max Drawdown By Duration End"]

duration_of_longest_drawdown = report["Duration of Longest Drawdown (Days)"]

average_yearly_return = report["Avg Yearly Return"]

x = np.arange(0, len(balance), 1)

plt.plot(x, balance)

# Highlight the period of maximum drawdown with a red bar

x = [max_drawdown_byper_start, max_drawdown_byper_end]

y = [balance[max_drawdown_byper_start], balance[max_drawdown_byper_start]]

plt.plot(x, y, color='tab:red', alpha=0.85, linewidth=2)

# Highlight the period of longest drawdown with an orange bar

x = [max_drawdown_bydur_start, max_drawdown_bydur_end]

y_range = np.max(balance) - np.min(balance)

if (max_drawdown_byper_start, max_drawdown_byper_end) == (max_drawdown_bydur_start, max_drawdown_bydur_end):

y = [balance[max_drawdown_bydur_start] + 0.025 * y_range, balance[max_drawdown_bydur_start] + 0.025 * y_range]

else:

y = [balance[max_drawdown_bydur_start], balance[max_drawdown_bydur_start]]

plt.plot(x, y, color='tab:orange', alpha=0.85, linewidth=2)

legend_labels = ["Longest Drawdown", "Max Drawdown"]

legend_patches = [mpatches.Patch(facecolor='orange', alpha=0.8),

mpatches.Patch(facecolor='red', alpha=0.8)]

# Create the legend in the bottom right-hand corner

plt.legend(legend_patches, legend_labels, loc='lower right', fancybox=True,

borderaxespad=0.5, frameon=True, edgecolor='black')

plt.text(0.03, 0.95, f'Avg Daily Return (%): {average_daily_return:.4f} %', transform=plt.gca().transAxes)

plt.text(0.03, 0.90, f'Avg Drawdown (%): {average_drawdown:.4f} %', transform=plt.gca().transAxes)

plt.text(0.03, 0.85, f'Avg Drawdown Duration (Days): {average_drawdown_duration:.2f}', transform=plt.gca().transAxes)

plt.text(0.03, 0.80, f'Max Drawdown (%): {max_drawdown_byper:.4f} %', transform=plt.gca().transAxes)

plt.text(0.03, 0.75, f'Duration of Max Drawdown (Days): {duration_of_max_drawdown}', transform=plt.gca().transAxes)

plt.text(0.03, 0.70, f'Longest Drawdown (%): {max_drawdown_bydur:.4f} %', transform=plt.gca().transAxes)

plt.text(0.03, 0.65, f'Duration of Longest Drawdown (Days): {duration_of_longest_drawdown}', transform=plt.gca().transAxes)

plt.text(0.03, 0.60, f'Avg Yearly Return (%): {average_yearly_return:.4f} %', transform=plt.gca().transAxes)

plt.title(f"{day_num} Day Simulation (Seed: {random_seed})", fontsize = 20)

plt.ylabel("Account Value", fontsize = 20)

plt.xlabel("Day", fontsize = 20)

plt.show()

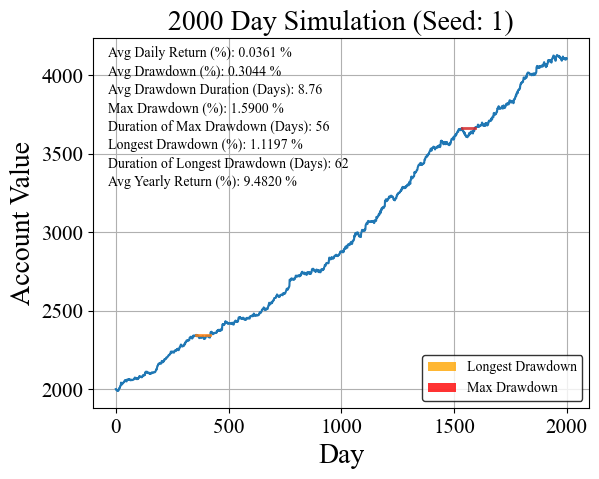

The account value as a function of time is plotted above. Out of the gate the algorithm seems to perform relatively well, with minimal drawdown percentage, and a reasonable drawdown duration. For the most part the balance seems to be a steadily increasing function with some moderate noise. Note: There are about 252 trading days in a year (leap years make things complicated), so 2000 days is roughly 8 years. Despite its solid performance on the drawdowns, the avg yearly return is still pretty much the same as the standard S&P 500. This is only for one seed, one random set of 2000 days. Let’s try running this a few times more times to get an idea of how it performs.

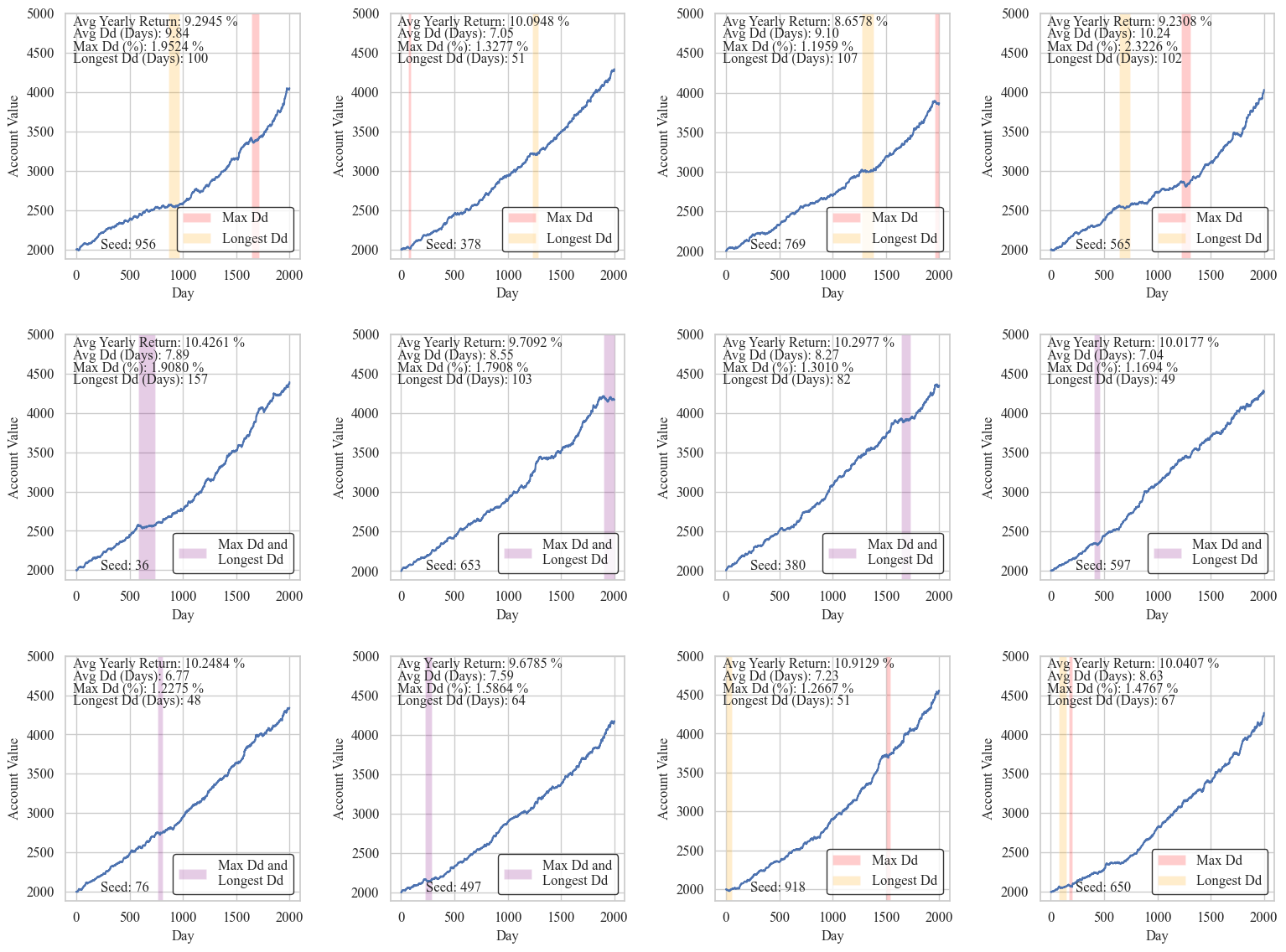

12 random, 2000 day simulations

(Here Dd stands for Drawdown)

import matplotlib.patches as mpatches

# Create a 3x4 grid of subplots

nrows = 3

ncols = 4

fig, axs = plt.subplots(nrows, ncols, figsize=(4*ncols, 4*nrows))

fig.tight_layout(pad=3.0)

day_num = 2000

starting_balance = 2000

x_percent_loss = -0.2 / 100 # x percent loss threshold

y_percent_gain = 0.5 / 100 # y percent gain threshold

be_threshold = 0.3 / 100 # breakeven threshold

tslp = 0.2 / 100 # trailing stop loss percentage

# Loop through the random seeds and parameter sets

seed_counter = 0

seeds = [random.randint(1, 1000) for _ in range(12)]

for i in range(nrows):

for j in range(ncols):

# Simulate the algorithm for the current random seed and parameter set

report = my_algorithm(seeds[seed_counter], day_num, starting_balance, x_percent_loss, y_percent_gain, be_threshold, tslp)

balance = report["Balance"]

# Plot the balance on the corresponding subplot

axs[i, j].plot(np.arange(0, len(balance), 1), balance)

# Add text to the subplot

axs[i, j].text(0.03, 0.95, f'Avg Yearly Return: {report["Avg Yearly Return"]:.4f} %', transform=axs[i, j].transAxes, fontsize=12)

axs[i, j].text(0.03, 0.90, f'Avg Dd (Days): {report["Avg Drawdown Duration (Days)"]:.2f}', transform=axs[i, j].transAxes, fontsize=12)

axs[i, j].text(0.03, 0.85, f'Max Dd (%): {report["Max Drawdown By Percent"]:.4f} %', transform=axs[i, j].transAxes, fontsize=12)

axs[i, j].text(0.03, 0.80, f'Longest Dd (Days): {report["Duration of Longest Drawdown (Days)"]}', transform=axs[i, j].transAxes, fontsize=12)

axs[i, j].text(0.15, 0.04, f"Seed: {seeds[seed_counter]}", transform=axs[i, j].transAxes)

# Highlight the period of maximum drawdown with a red bar

max_p_start = report["Max Drawdown By Percent Start"]

max_p_end = report["Max Drawdown By Percent End"]

# Highlight the period of longest drawdown with a blue bar

max_d_start = report["Max Drawdown By Duration Start"]

max_d_end = report["Max Drawdown By Duration End"]

if max_p_start == max_d_start and max_p_end == max_d_end:

axs[i, j].axvspan(max_p_start, max_p_end, facecolor='purple', alpha=0.2)

legend_labels = ["Max Dd and\nLongest Dd"]

legend_patches = [mpatches.Patch(facecolor='purple', alpha=0.2)]

else:

legend_labels = ["Max Dd", "Longest Dd"]

legend_patches = [mpatches.Patch(facecolor='red', alpha=0.2),

mpatches.Patch(facecolor='orange', alpha=0.2)]

axs[i, j].axvspan(max_p_start, max_p_end, facecolor='red', alpha=0.2)

axs[i, j].axvspan(max_d_start, max_d_end, facecolor='orange', alpha=0.2)

# Create the legend in the bottom right-hand corner

axs[i, j].legend(legend_patches, legend_labels, loc='lower right', fancybox=True,

borderaxespad=0.5, fontsize=12, frameon=True,

edgecolor='black')

seed_counter += 1

# Add common labels

for ax in axs.flat:

ax.set(xlabel="Day", ylabel="Account Value")

ax.xaxis.label.set_fontsize(12)

ax.yaxis.label.set_fontsize(12)

ax.tick_params(axis='x', labelsize=12)

ax.tick_params(axis='y', labelsize=12)

ax.set_yticks([2000, 2500, 3000, 3500, 4000, 4500, 5000])

ax.set_yticklabels([2000, 2500, 3000, 3500, 4000, 4500, 5000])

# Show the plot

plt.show()

Alright, at least with this small sample of simulations our results are pretty consistent.

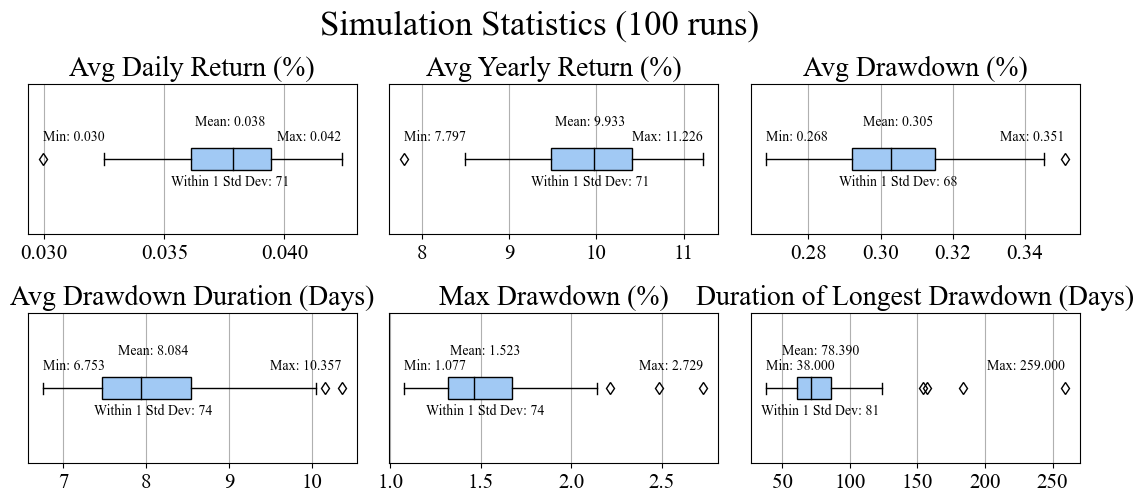

Now what we really need to do is run this simulation many more times look at the performance metric statistics across a lot of seeds.

def stats_from_many_runs(parameters, categories, number_of_sims):

day_num = parameters[0]

starting_balance = parameters[1]

x_percent_loss = parameters[2]

y_percent_gain = parameters[3]

be_threshold = parameters[4]

tslp = parameters[5]

data = [[] for i in categories]

seeds = [int(i) for i in range(0, number_of_sims, 1)]

for seed in seeds:

report = my_algorithm(seed, day_num, starting_balance, x_percent_loss, y_percent_gain, be_threshold, tslp)

for i in range(len(categories)):

data[i].append(report[categories[i]])

# Calculate mean, max, min, and values within one standard deviation

def calculate_summary_stats(data):

mean = np.mean(data)

max_val = np.max(data)

min_val = np.min(data)

std_dev = np.std(data)

within_std_dev = [x for x in data if mean - std_dev <= x <= mean + std_dev]

return mean, max_val, min_val, within_std_dev

# Calculate summary statistics for each category

stats = [calculate_summary_stats(i) for i in data]

return data, stats

# Parameters

day_num = 2000

starting_balance = 2000

x_percent_loss = -0.2 / 100 # x percent loss threshold

y_percent_gain = 0.5 / 100 # y percent gain threshold

be_threshold = 0.3 / 100 # breakeven threshold

tslp = 0.2 / 100 # trailing stop loss percentage

categories = [

"Avg Daily Return",

"Avg Yearly Return",

"Avg Drawdown",

"Avg Drawdown Duration (Days)",

"Max Drawdown By Percent",

"Duration of Longest Drawdown (Days)"

]

number_of_sims = 100

# Unoptimized parameters

data_unop, stats_unop = stats_from_many_runs([day_num, starting_balance, x_percent_loss, y_percent_gain, be_threshold, tslp], categories, number_of_sims)

from matplotlib import ticker

import seaborn as sns

nrows = 2

ncols = 3

fig, axs = plt.subplots(nrows, ncols, figsize=(4*ncols, 2.5*nrows))

fig.tight_layout(pad=3.0)

custom_titles = [

"Avg Daily Return (%)",

"Avg Yearly Return (%)",

"Avg Drawdown (%)",

"Avg Drawdown Duration (Days)",

"Max Drawdown (%)",

"Duration of Longest Drawdown (Days)"

]

for i in range(len(categories)):

ax = axs.flatten()[i]

ax.boxplot(data_unop[i], vert=False, sym="d",

boxprops=dict(facecolor=sns.color_palette("pastel")[0]),

medianprops=dict(color='black'),

patch_artist=True)

ax.set_title(custom_titles[i])

ax.yaxis.set_visible(False)

# Add statistics text to the plot

text_color = 'black'

mean, max_val, min_val, within_std_dev = stats_unop[i]

ax.text(mean, 1.25, f"Mean: {mean:.3f}", color=text_color, verticalalignment='center',horizontalalignment='center')

ax.text(max_val, 1.15, f"Max: {max_val:.3f}", color=text_color, verticalalignment='center', horizontalalignment='right')

ax.text(min_val, 1.15, f"Min: {min_val:.3f}", color=text_color, verticalalignment='center', horizontalalignment='left')

ax.text(mean, 0.85, f"Within 1 Std Dev: {len(within_std_dev)}", color=text_color, verticalalignment='center', horizontalalignment='center')

plt.subplots_adjust(wspace=0.1)

fig.suptitle(f"Simulation Statistics ({number_of_sims} runs)", y=1.05, fontsize = 25)

plt.show()

Section 4: Parameter Optimization with Genetic Algorithms (GAs)

Awesome, now we have a solid baseline of the algorithm’s performance, at least with the current parameters. Compared to a buy and hold strategy of the S&P 500, we have significantly lower maximum drawdowns and drawdown durations (source) The average yearly returns however aren’t bad, but they are definitely at or a little below the standard 10% value (any excess return compared to the benchmark 10% average of the S&P 500 is commonly referred to as “alpha”). We have one last trick up our sleeve though; the parameters we have been using for our 4 variables in our algorithm are just ones that I chose from a little trial and error, there is likely some performance still left on the table.

Similar to hill climbing or simulated annealing, GAs are a way of finding the optimal solution to a problem. GAs are a metaheuristic that mimics nature by using a “population” of solutions, and then selectively breeding and mutating them to try to find the “fittest” possible solution. They can be very efficient due to the fact that information about the phase space is shared between members of the population through breeding. We can use the python package pygad to do most of the work for us, and set up the algorithm with a few specialty crossover (breeding) and mutation functions to make sure that we avoid an solutions that don’t open simple logic (like setting our trailing stop loss above our take profit).

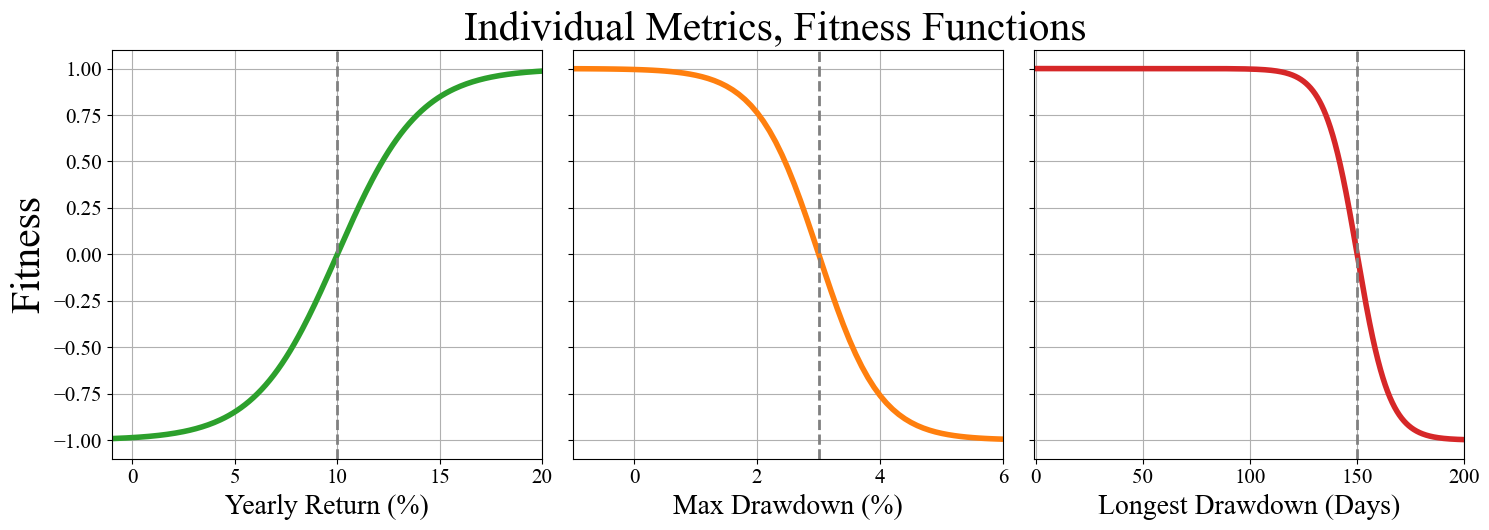

We also need to be careful about how we define fitness, as this is essentially the value being optimized. Values that score better on the fitness function have a better chance of having their genes passed on to the next generation. For us, we want the largest yearly return with the smallest drawdown values. An easy solution is to write 3 separate fitness functions for our 3 metrics, plotted below. We will use hyperbolic tangent (tanh) functions to get a smoothly varying number between 0 and 1 depending on the performance metric. We will center each tanh function near the average values from our 100 simulated runs.

x = np.arange(-1, 200, 0.1)

y_yearly = np.tanh(x / 4 - 2.5)

y_maxdd = -1 * np.tanh(x - 3)

y_longdd = -1 * np.tanh(x / 15 - 10)

# Create the subplots

fig, axs = plt.subplots(1, 3, figsize=(15, 5), sharey=True)

plt.subplots_adjust(hspace=0)

axs[0].plot(x, y_yearly, color="tab:green", linewidth=4)

axs[1].plot(x, y_maxdd, color="tab:orange", linewidth=4)

axs[2].plot(x, y_longdd, color="tab:red", linewidth=4)

axs[0].set_xlim(-1,20)

axs[0].axvline(x=10, color='gray', linestyle='--', linewidth=2)

axs[0].set_xlabel('Yearly Return (%)', fontsize=20)

axs[0].set_ylabel('Fitness', fontsize=30)

axs[1].set_xlim(-1,6)

axs[1].axvline(x=3, color='gray', linestyle='--', linewidth=2)

axs[1].set_xlabel('Max Drawdown (%)', fontsize=20)

axs[2].set_xlim(-1,200)

axs[2].axvline(x=150, color='gray', linestyle='--', linewidth=2)

axs[2].set_xlabel('Longest Drawdown (Days)', fontsize=20)

# Adjust the layout and remove vertical space between subplots

plt.tight_layout(h_pad=0)

fig.suptitle("Individual Metrics, Fitness Functions", y=1.05, x = 0.52, fontsize = 30)

# Show the plot

plt.show()

We can then combine all 3 of these together into a single fitness function simply by adding them all together. We have our GA set up to maximize a value, so we can take the inverse of 1 / (6 - (4 * yearly fitness + max drawdown fitness + longest drawdown fitness)) as our final fitness function. Multiplying the yearly fitness by 4 is a quick way of weighting its importance higher than the other two metrics. We do at the end of the day, want to find something which can outperform the underlying asset.

The final note about how fitness is determined is something we actually alluded to earlier. We want the GA to find the optimal solution to any random set of days. This means we can’t use the same random set every time the fitness function is called, otherwise it will only find the optimal values for that specific set of days. To get around this, we can use the same 30 random subsets and average the metrics over them.

This is a necessary step for ensuring the quality of our final optimization, but we are reaching the limit of what is considered reasonable computational time. We’re looking at a maximum of 390 minutes every day, for 2000 days, for 30 different random configurations, for 16 different sets of parameters (solutions). It’s possible that we could come up with a cheaper fitness function such as evaluating on a 5 or 10 minute time frame, which would actually be a very reasonable compromise. Or we can just go the brute force route and put our fancy CPUs to use by using pygad’s built in multiprocessing capabilities. Doing it this way will also allow us to be greedy with our fitness function and average over a larger number of random configurations.

Multiprocessing isn’t the kind of thing that can be done in a Jupyter notebook, so the modified code is in the parallel_GA.py file in the Github repository, but the main bulk of it is also copied below if you’d like to see a genetic algorithm is implemented with pygad.

# This will run, but will take a long time during the evaluation stage because the population is running sequentially instead of in parallel.

import pygad

day_num = 2000

starting_balance = 2000

def are_params_logical(solution):

x_percent_loss = solution[0]

y_percent_gain = solution[1]

be_threshold = solution[2]

tslp = solution[3]

if -1*x_percent_loss > (y_percent_gain - tslp):

return False

elif be_threshold < -1 * x_percent_loss:

return False

elif be_threshold > y_percent_gain:

return False

elif tslp > y_percent_gain:

return False

elif x_percent_loss >= 0:

return False

elif y_percent_gain <= 0:

return False

elif be_threshold <= 0:

return False

elif tslp <= 0:

return False

return True

def fitness_function(ga_instance, solution, solution_idx):

x_percent_loss = solution[0]

y_percent_gain = solution[1]

be_threshold = solution[2]

tslp = solution[3]

if not(are_params_logical(solution)):

print("Solution did not satisfy logical requirements")

return -99999

profit_fitness = 0

max_drawdown_fitness = 0

longest_drawdown_dur_fitness = 0

seeds = [int(i) for i in np.arange(0, 30, 1)]

for seed in seeds:

report = my_algorithm(seed, day_num, starting_balance, x_percent_loss / 100, y_percent_gain / 100, be_threshold / 100, tslp / 100)

# Use this when using algorithm with no slippage

profit_fitness += np.tanh(report["Avg Yearly Return"] / 4 - 2.5) # tanh function stretched and centered at 10

max_drawdown_fitness += -1 * np.tanh(report["Max Drawdown By Percent"] - 3) # negative tanh function centered at 3.0

longest_drawdown_dur_fitness += -1 * np.tanh(report["Duration of Longest Drawdown (Days)"] / 15 - 10) # Centered near 150

# Average the fitnesses over the number of runs

profit_fitness = profit_fitness / len(seeds) * 4 # More heavily weight profit over drawdowns

max_drawdown_fitness = max_drawdown_fitness / len(seeds)

longest_drawdown_dur_fitness = longest_drawdown_dur_fitness / len(seeds)

total_fitness = profit_fitness + max_drawdown_fitness + longest_drawdown_dur_fitness # At it's peak this should have a value of 6

print(profit_fitness, max_drawdown_fitness, longest_drawdown_dur_fitness, 1 / (6 - total_fitness))

return 1 / (6 - total_fitness)

num_generations = 20

num_parents_mating = 8

# Define the number of solutions and genes

num_solutions = 16

num_genes = 4

# Define initialization ranges for each gene

gene_ranges = [

(-1, -0.2), # x_percent_loss

(0.12, 10), # y_percent_gain

(0.2, 1.5), # be_threshold

(0.2, 5) # tslp

]

# Initialize an empty population array

initial_population = np.empty((num_solutions, num_genes))

# Generate random values for each gene in each solution within the specified ranges

def generate_solution():

solution = []

for j in range(num_genes):

gene_min, gene_max = gene_ranges[j]

gene_value = np.random.uniform(gene_min, gene_max)

solution.append(gene_value)

while not(are_params_logical(solution)):

solution = []

for j in range(num_genes):

gene_min, gene_max = gene_ranges[j]

gene_value = np.random.uniform(gene_min, gene_max)

solution.append(gene_value)

return(solution)

initial_population = [generate_solution() for i in range(num_solutions)]

"""

Roulette Wheel Selection (rws): Roulette wheel selection assigns each individual in

the population a slice of a roulette wheel,

with the size of the slice proportional to their fitness.

Then, a random spin of the wheel determines which individuals are selected as parents.

This method tends to favor individuals with higher fitness values.

"""

parent_selection_type = "rws" # Roulette Wheel Selection

keep_parents = 0

keep_elitism = 1

mutation_probability = 0.4 # Every gene of every solution has a some percent chance of being mutated

# Define your custom callback function

def custom_callback(ga_instance):

generation = ga_instance.generations_completed

print(ga_instance.best_solution())

print(ga_instance.population)

def crossover_func(parents, offspring_size, ga_instance):

offspring = []

for _ in range(offspring_size[0]):

# Randomly select two different parents

parent_indices = np.random.choice(range(len(parents)), size=2, replace=False)

parent1 = parents[parent_indices[0], :].copy()

parent2 = parents[parent_indices[1], :].copy()

random_split_point = np.random.choice(range(offspring_size[0]))

child_solution = np.concatenate((parent1[random_split_point:], parent2[:random_split_point]))

counter = 0

while not(are_params_logical(child_solution)):

random_split_point = np.random.choice(range(offspring_size[0]))

child_solution = np.concatenate((parent1[random_split_point:], parent2[:random_split_point]))

if counter > 20: # Avoid infinite loop

print("Crossover got stuck in while loop with parents\n", parent1, "\n", parent2)

child_solution = generate_solution()

counter += 1

offspring.append(child_solution)

return np.array(offspring)

def mutation_func(offspring, ga_instance):

minmax_by_gene = [[-1,1] for i in range(offspring.shape[1])]

minmax_by_gene[0] = [-0.2, 0.2]

for chromosome_idx in range(offspring.shape[0]):

for gene_idx in range(offspring.shape[1]):

if random.randint(1, 100) / 100 <= mutation_probability:

mutation_arr = np.zeros(offspring.shape[1])

mutation_arr[gene_idx] += np.random.uniform(minmax_by_gene[gene_idx][0], minmax_by_gene[gene_idx][1])

new_solution = offspring[chromosome_idx] + mutation_arr

counter = 0

while not(are_params_logical(new_solution)):

mutation_arr = np.zeros(offspring.shape[1])

mutation_arr[gene_idx] += np.random.uniform(minmax_by_gene[gene_idx][0], minmax_by_gene[gene_idx][1])

new_solution = offspring[chromosome_idx] + mutation_arr

if counter > 20: # Avoid infinite loop

print("Mutation got stuck in while loop with initial values of", offspring[chromosome_idx])

new_solution = offspring[chromosome_idx] # Don't mutate anything

break

counter += 1

offspring[chromosome_idx] = new_solution

return offspring

ga_instance = pygad.GA(num_generations=num_generations,

num_parents_mating=num_parents_mating,

fitness_func=fitness_function,

initial_population = initial_population,

parent_selection_type=parent_selection_type,

keep_parents=keep_parents,

keep_elitism=keep_elitism,

crossover_type=crossover_func,

mutation_type=mutation_func,

suppress_warnings=True,

on_generation=custom_callback,

allow_duplicate_genes=False,

save_solutions=True,

parallel_processing=["process", 16],

stop_criteria=["reach_0.8"])

ga_instance.run()

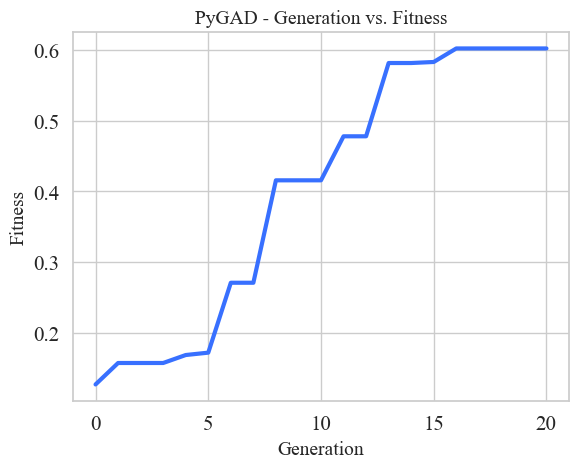

Similar to the raw dataset, I have the converged optimization run pickled. We can load it up and plot it’s progress.

import pickle

with open('ga_instance.pkl', 'rb') as f:

ga_instance = pickle.load(f)

converged_solution, solution_fitness, solution_idx = ga_instance.best_solution()

print("Parameters of the best solution : {solution}".format(solution=converged_solution))

print("Fitness value of the best solution = {solution_fitness}".format(solution_fitness=solution_fitness))

Parameters of the best solution : [-0.03598936 4.05120881 0.12783813 1.46633441]

Fitness value of the best solution = 0.6025662769412933

ga_instance.plot_fitness()

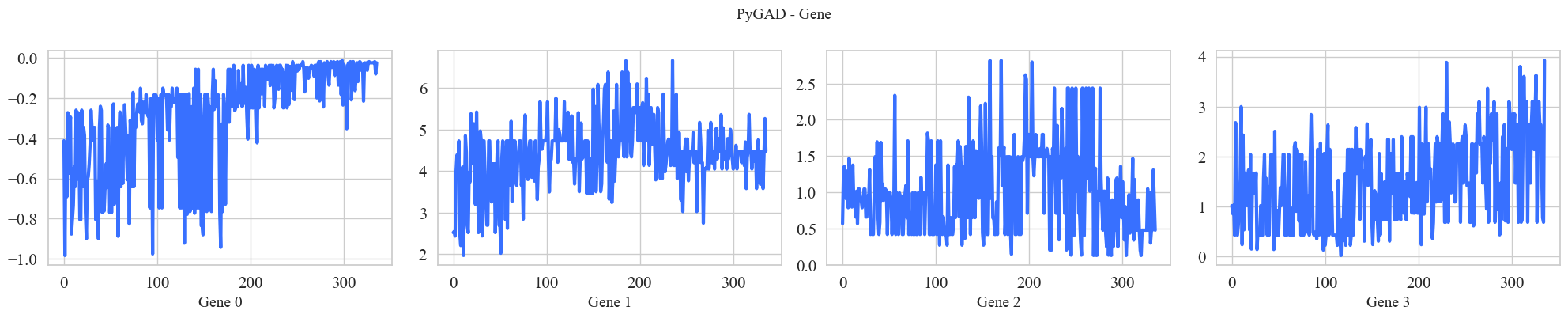

ga_instance.plot_genes()

ga_instance.plot_genes(graph_type="boxplot")

plt.show()

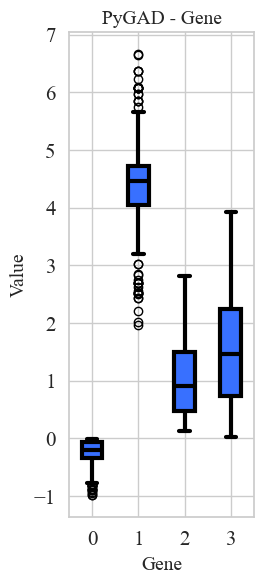

The results of the converged optimization are above. Please excuse the color choices and text sizing, I’m just using the built in PyGAD plotting functions. We can see that the GA has more or less converged with an optimal fitness score of 0.6. The genes are ordered the same as the parameters:

Gene 0 -> x_percent_loss

Gene 1 -> y_percent_gain

Gene 2 -> be_threshold

Gene 3 -> tslp

A few interesting things jump out.

1) The optimized values tell us that having a very small initial stop loss and a very large take profit performs best. The x_percent_loss values quick trend to zero, and y_percent_gain bounces around 4 or 5 percent for the majority of the generations.

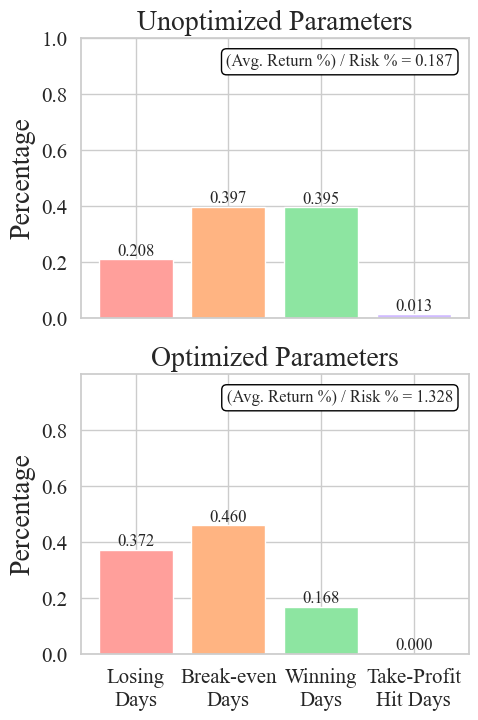

2) As a result of 1), the breakeven threshold doesn’t end up playing much of a roll in the overall algorithm. The x_percent_loss is set so low, that moving your remaining stop loss to breakeven corresponds to just a few hundredths of a percentage point. As we will see later, this results in very few breakeven days.

3) The y_percent_gain being set so high means that it rarely gets triggered. This means that the algorithm is only seeking to secure gains (take profit) on the most highly volatile days.

Let’s take a look at how the statistics of these new optimized parameters compare to our starting ones.

# Parameters

day_num = 2000

starting_balance = 2000

x_percent_loss = converged_solution[0] / 100 # x percent loss threshold

y_percent_gain = converged_solution[1] / 100 # y percent gain threshold

be_threshold = converged_solution[2] / 100 # breakeven threshold

tslp = converged_solution[3] / 100 # trailing stop loss percentage

categories = [

"Avg Daily Return",

"Avg Yearly Return",

"Avg Drawdown",

"Avg Drawdown Duration (Days)",

"Max Drawdown By Percent",

"Duration of Longest Drawdown (Days)"

]

number_of_sims = 100

# Unoptimized parameters

data_op, stats_op = stats_from_many_runs([day_num, starting_balance, x_percent_loss, y_percent_gain, be_threshold, tslp], categories, number_of_sims)

nrows = 2

ncols = 3

fig, axs = plt.subplots(nrows, ncols, figsize=(3*ncols, 4*nrows))

custom_titles = [

"Avg Daily Return (%)",

"Avg Yearly Return (%)",

"Avg Drawdown (%)",

"Avg Drawdown Duration (Days)",

"Max Drawdown (%)",

"Duration of Longest Drawdown (Days)"

]

custom_xlims = [

(0.02, 0.05),

(5, 13),

(0.4, 0.65),

(5, 20),

(0, 8),

(20, 500)

]

for i in range(len(categories)):

ax = axs.flatten()[i]

bplot1 = ax.boxplot(data_unop[i], sym="d",

boxprops=dict(facecolor=sns.color_palette("pastel")[0]),

medianprops=dict(color='black'),

patch_artist=True, positions=[1])

bplot2 = ax.boxplot(data_op[i], sym="d",

boxprops=dict(facecolor=sns.color_palette("pastel")[1]),

medianprops=dict(color='black'),

patch_artist=True, positions=[1.5])

ax.set_xlim(0, 2.5)

ax.set_title(f"{custom_titles[i]}", fontsize=15)

ax.tick_params(axis='both', which='major', labelsize=12)

ax.xaxis.set_visible(False)

ax.yaxis.set_major_locator(ticker.MaxNLocator(5))

ax.grid(True)

# Add statistics text to the plot

fontsize = 10

text_color = sns.color_palette("muted")[0]

mean, max_val, min_val, within_std_dev = stats_unop[i]

ax.text(0.85, mean, f"Mean: {mean:.3g}", color=text_color, verticalalignment='center',horizontalalignment='right',fontsize=fontsize)

ax.text(0.85, max_val, f"Max: {max_val:.3g}", color=text_color, verticalalignment='center', horizontalalignment='right',fontsize=fontsize)

ax.text(0.85, min_val, f"Min: {min_val:.3g}", color=text_color, verticalalignment='center', horizontalalignment='right',fontsize=fontsize)

text_color = sns.color_palette("muted")[1]

mean, max_val, min_val, within_std_dev = stats_op[i]

if max_val - mean < (ax.get_ylim()[1] - ax.get_ylim()[0]) * 0.05:

max_val += (ax.get_ylim()[1] - ax.get_ylim()[0]) * 0.025

if mean - min_val < (ax.get_ylim()[1] - ax.get_ylim()[0]) * 0.05:

min_val -= (ax.get_ylim()[1] - ax.get_ylim()[0]) * 0.025

ax.text(1.65, mean, f"Mean: {mean:.3g}", color=text_color, verticalalignment='center',horizontalalignment='left',fontsize=fontsize)

ax.text(1.65, max_val, f"Max: {max_val:.3g}", color=text_color, verticalalignment='center', horizontalalignment='left',fontsize=fontsize)

ax.text(1.65, min_val, f"Min: {min_val:.3g}", color=text_color, verticalalignment='center', horizontalalignment='left',fontsize=fontsize)

legend_labels = ["Unoptimized", "Optimized"]

legend_patches = [mpatches.Patch(facecolor=sns.color_palette("pastel")[0], alpha=0.8),

mpatches.Patch(facecolor=sns.color_palette("pastel")[1], alpha=0.8)]

# Create the legend in the bottom right-hand corner

fig.legend(legend_patches, legend_labels, loc='upper right', fancybox=True,

borderaxespad=0.5, frameon=True, edgecolor='black')

plt.subplots_adjust(wspace=0.1)

fig.suptitle(f"Simulation Statistics ({number_of_sims} runs)", x=0.53, y=1, fontsize = 25)

fig.tight_layout(h_pad=2, w_pad=0.1)

plt.show()

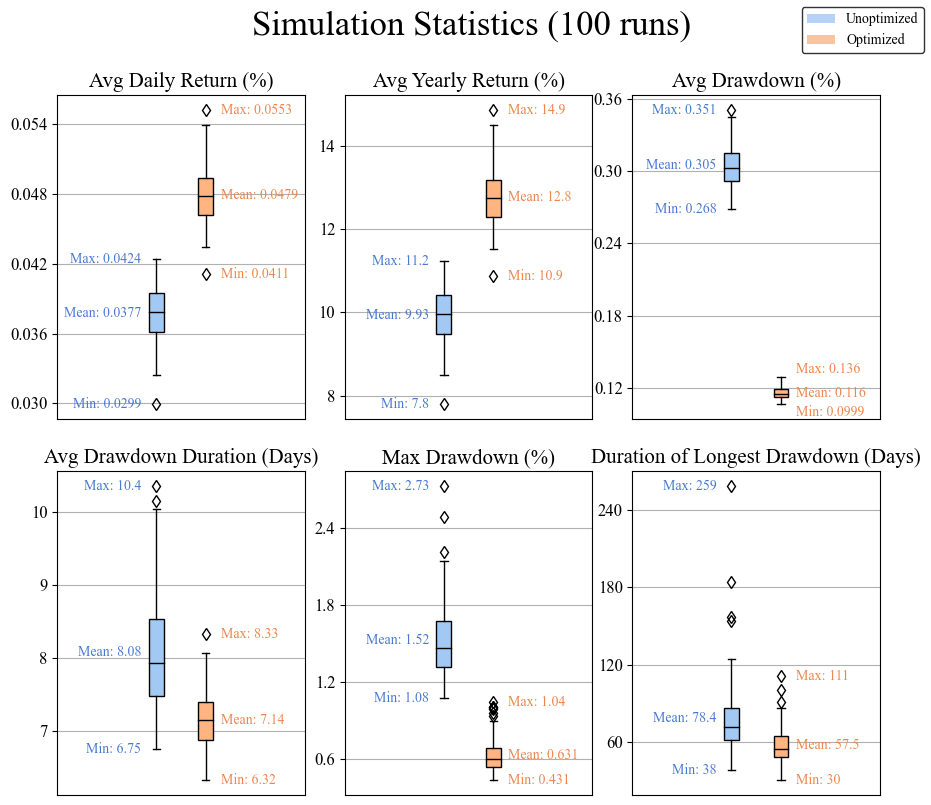

The above plot compares the performance across 100 random runs using our old and newly opimized paraterms. Looking at this, we can confidently say that the optimzation with the GA was successful! The average yearly return increased by 2.5% (~10% to ~12.5%) compared to our unoptimized values that we started with. This gives an alpha of about 2.5% compared to the benchmark of 10% annually. The average maximum drawdown and average longest drawdown also decreased significantly. In this case if we use the standard S&P 500 as a benchmark, this algorithm is blowing it out of the water. The advantage of using both long and short positions means that we are much more resistant steep declines due to recessions, because we remain profitable as long a the price action does not become stagnant.

Before we wrap up, it would be helpful to try to understand why these more extreme parameters that the GA found give us more favorable results. Let’s look back at our dataset and see if we can learn the same lessons the GA did.

def calculate_day_results(report, x_percent_loss, y_percent_gain):

""" Calculate the number of loosing, breakeven, and winning days as well as the return:risk ratio"""

balance = report["Balance"]

day_results = []

returns = []

for key, day in enumerate(balance):

if key == 0:

continue

else: